Facts About Consumer Debt

In total, U.S. consumer debt – comprised of mortgages, auto loans, and credit cards – reached $13.86 trillion in Q3 2019. So, if you are a consumer in the US and have debt of any kind, know that you are not alone. While some consumer debt is considered an investment or “necessary” as opposed to the result of frivolous spending, more than 189 million Americans have at least one credit card and carry a balance. On average, each credit card holder has four cards and a household with a credit card holder carries approximately $8,398 in credit card debt.

The thing with debt is that while it may be planned or unplanned (or a combination of both) and can be somewhat unavoidable in today’s society, it is manageable. While debt can turn ugly very quickly if not managed properly, every day Americans are learning how to successfully dig themselves out of debt and travel down a lighted path to financial freedom.

Understanding Your Personal Debt

The first step in reducing or eliminating personal debt is to create a full understanding of your financial situation. This can be your personal situation or, if you are married or in a relationship, consider combining your information to tackle the challenge together. Creating that full view of your financial situation includes knowing:

- Total household income

- Debt total

- Sources of debt

- Interest rates

- Payment terms

- Payment status

- Income outlook

- Personal credit score

Once you compile this personal data into one view, you will have a better outlook on your situation. If you are having trouble figuring out what it all means or how to organize the information, consider reaching out to an Inspire FCU representative to help. Once you have that full view and corresponding insights, you can determine an approach that is best suited for your situation and will be compatible with your mindset and personal perspective.

Debt Management Methods

There are three common approaches to reduce and/or eliminate debt — The Snowball Effect, The Big Bang, and The Debt Avalanche. Each method has its own benefits and drawbacks, but in the end, the success of any method is in direct correlation with the mindset of the individual and how closely the method is followed.

The Debt-Snowball Effect

When applying The Snowball Effect method, you must focus on paying off smaller debts first, then moving into larger debts. By looking at each of your debts separately, you can determine the total balance of each and place them in order of smallest to highest. Work through paying off the smallest and then move onto the larger debts as you cross the smaller totals off your list.

The psychological effect is that as you pay off each smaller debt, you start to see the needle move and that becomes motivation and momentum to stick with the process and continue paying off debt. This process is meant to build confidence for those who may feel that settling their debt is a challenging process and may not be able to see the light at the end of the tunnel when getting started. This method is best for those who thrive off experiencing “little wins” and may need a confidence boost to reach the end goal.

The Big Bang Approach

The Big Bang method is the opposite approach of The Snowball Effect. The focus of this method is on paying a large sum toward the biggest debt and doing your best to eliminate it as soon as possible. For instance, if you have a credit card with a high interest rate with a high balance, it may make sense to focus on reducing and eliminating that debt. If you have savings or access to cash, you may want to pay this debt. This will alleviate a big burden by decreasing your total debt quickly, and you will avoid adding to that debt through interest accrual.

If you do not have access to a large sum of cash, but feel that this approach may be best, one option to implement The Big Bang method is to apply for a personal line of credit and use that toward a large payment. If you are not familiar, a personal line of credit is a direct line of cash that can be used for any purpose. If you receive a line of credit and use it toward a large debt, it may end up saving money down the road based on the interest rates. In general, credit unions offer a much lower interest rate on personal lines of credit than most creditors offer on cards.

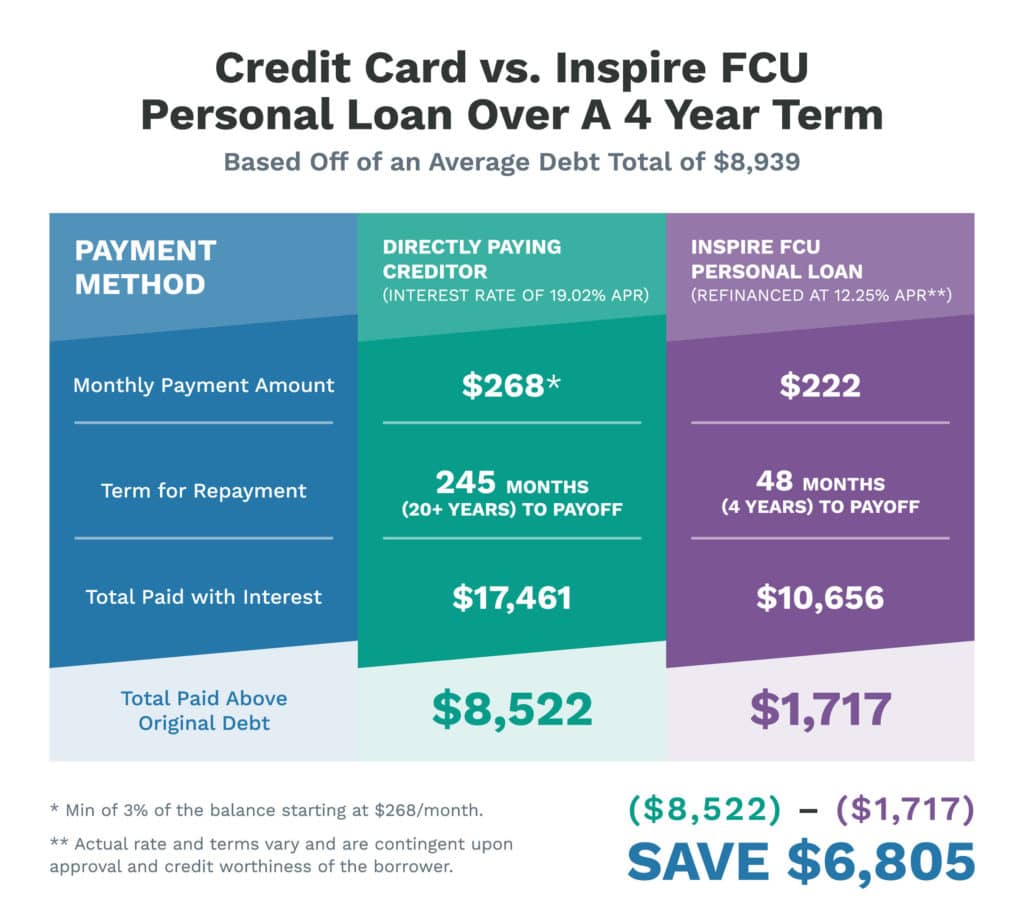

Consider the numbers and how a personal line of credit from Inspire FCU compares to paying a credit card minimum. The personal line of credit can absolutely help you get out of debt quicker and save money.

By using a personal loan to refinance credit card debt, an individual who qualifies for a refi rate of 12.25% on their debt can pay it off in four years totaling $10,656, versus $17,461 on the original credit card — saving a total of over $6,800! In contrast, an individual paying the minimum on a monthly basis will take 20 years to pay off the debt total and it will cost them almost double the amount of the original balance — that is not saving money nor is it eliminating debt in a timely manner.

The Debt Avalanche Method

For those with debt that may be scattered in terms of type and total, the calculated approach may be a good fit. This method focuses on the overall situation and then separates the debt by amount owed, interest rates, and feasibility of payoff. From there, based on totals, interest rates, and type of debt, you can determine which debt makes the most sense to pay off and in which order.

For example, if you carry a large balance on a high interest credit card, consider chipping away at a portion of the debt while also paying more than the minimum on a credit card with a lower sum and interest rate. Do this while continuing to pay the minimum on your mortgage or auto loan until one of the credit card debts is cleared.

How to Start Saving and Reduce Debt Now

No matter which method you choose to apply to your debt, one of the best things you can do right now is to start saving. Save by eliminating unnecessary spending and look for ways to increase your income. You may also be able to increase your cash flow by looking at sources of “found money.” Consider the following:

- Negotiate interest rates – call your current creditors and ask if you are eligible for a lowered interest rate.

- Negotiate bills – reach out to your cell phone provider, Internet company, and/or home cable service and ask if you can take advantage of any current promotions or offers that may reduce your payments.

- Unsubscribe – look through your spending and unsubscribe to any unnecessary subscription services that you do not use and unsubscribe from any email lists that may prompt spending.

- Set goals – to keep yourself on track, consider small micro-savings goals such as saving your change, and/or anti-spending goals, which may include limiting the purchase of expensive beverages or only going out for dinner once a month.

Manage Your Personal Debt with Inspire FCU

However you choose to tackle your debt, know that managing personal debt is something that takes time and effort, but it is possible. If you aren’t sure where to start or need extra guidance, contact us and we can give you access to a financial planner who can help assess the situation and offer tools and options for management.

In the meantime, learn about personal loans and PLOC options at Inspire FCU and how our team can assist with debt reduction and elimination. Contact us or stop by a branch location to speak with a representative for more information, guidance, or advice.