Savings Accounts

Premium Purple

Earn the highest possible return on your money with full access to your funds!

-

-

Open your account in seconds

-

Conveniently access your funds via Digital Banking

-

$5,000 minimum deposit

-

$15 maintenance fee if average daily balance falls below $5,000

-

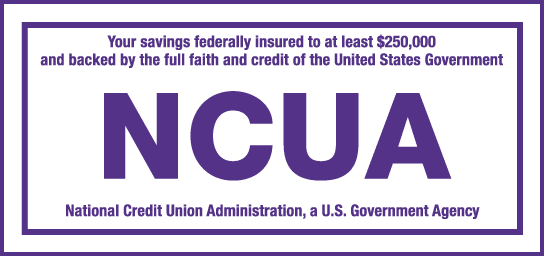

NCUA insured

Please visit our rates page for dividend rate disclosures.

See our fee schedule for any applicable fees.

Round Up Savings

-

100% match for the first 90 days*

-

Encourages positive saving habits

-

Helps you save daily

-

-

$100 minimum balance

-

Paired with Everyday Checking

Share Certificates

We offer share certificates with competitive rates and flexible terms to fit you!

Earn 5.25% APY* on a 6 month Jumbo Share Certificate!

-

Earn competitive dividends

-

Flexible terms to fit your goals!

-

Monitor your accounts with our Access via Digital Banking

-

$500 Minimum Balance to Open

-

-

Dividends paid quarterly

Regular Shares

Your share in the Credit Union!

-

Make transactions using ATMs* or at any Inspire FCU branch.

-

Primary Basic Savings Account

-

-

No monthly service charge

-

Account may be accessed via ATM if it is linked to an active checking account and debit card

-

No Minimum Balance to Open

Club Accounts

-

Holiday Club, Vacation Club, Secondary Savings

-

Accounts designed to help you achieve your short-term financial goals

-

-

NCUA insured to at least $250,000

-

No Minimum Balance to Open

-

Holiday Club balance will be transferred to another account of yours on or after October 1st.

Please visit our rates page for dividend rate disclosures.

See our fee schedule for any applicable fees.

Youth Accounts

-

Learn the importance of saving

-

Develop account management skills

-

-

No Minimum Balance to Open

Please visit our rates page for dividend rate disclosures.

See our fee schedule for any applicable fees.

Fill out the form below and we’ll be in touch to get you started.