What’s your home made of? It’s made of wood, brick, drywall, plumbing… But did you know that there’s also potential cash value in your home?

By understanding the equity in your home, you can tap into the financial power of your home and enjoy its benefits. Inspire FCU offers home equity loans and home equity lines of credit (HELOC) to help you take full advantage of your home’s value. Read on to learn more and find out how your home can help you reach your financial goals.

What Is Home Equity?

Home equity simply means the amount of money you’ve invested in the purchase of your home. It’s the fair market value of the home minus any outstanding mortgage balance. Equity can increase or decrease over time depending on if you borrow against the home (e.g. using a cash out refinance), how consistent you’ve been with making mortgage payments, and if your home’s value decreases or increases.

Let’s take a look at an example. If you use a mortgage to buy a home for $200,000 and the remaining loan balance is $50,000 after several years of mortgage payments, the equity is $150,000.

Typically, your initial equity will be the downpayment you paid for the home. With a 10% down payment on a $200,000 home, your equity will start at $20,000.

Monthly mortgage payments will pay off the principal of the loan with interest. As the principal decreases, the amount your home is worth increases.

How Does Home Value Affect Equity?

The more equity in your home, the better. But the value of your home will shift over time which can alter its equity. Ideally, your home’s value will increase over time. This depends on the elusive, ever-changing real estate market.

If your home was valued at $200,000 ten years ago but it’s now valued at $250,000, your home is worth more. This is because you spent $200,000 on something that is now worth $250,000.

If the market value of your home decreases over time, you’ll owe more than the home is worth. This is called being underwater.

So, how can you avoid your home becoming less valuable than when you bought it? One way is through home improvement projects. A kitchen remodel, landscaping, finishing a basement – these can all add value to your home and increase its equity.

Renovations and home improvement projects are not known for being cheap. One strategy to pay for them is with a home equity loan or HELOC. This gives you the opportunity to borrow the necessary funds as needed and only pay back on the amount you borrow.

The Basics Of Home Equity Loan And Home Equity Line Of Credit (HELOC)

Your home’s value can be used as collateral for loans and lines of credit. This is an effective way to turn your home’s value into cash. When you use the cash to add value to the home, it’s a win-win.

Two popular options are a home equity loan and a HELOC.

A fixed-rate home equity loan operates as a standard loan with a lump sum borrowed against the equity of your home. Fixed payments are made throughout the life of the loan. Terms are up to 240 months, during which time you can leverage the equity of your home to help you achieve other financial goals.

A HELOC, on the other hand, gives you the flexibility to use your home’s value like a credit card. You borrow what you need when you need it. There’s a 10-year draw period during which you can use money. Repayment will fluctuate depending on what is borrowed and the current rate.

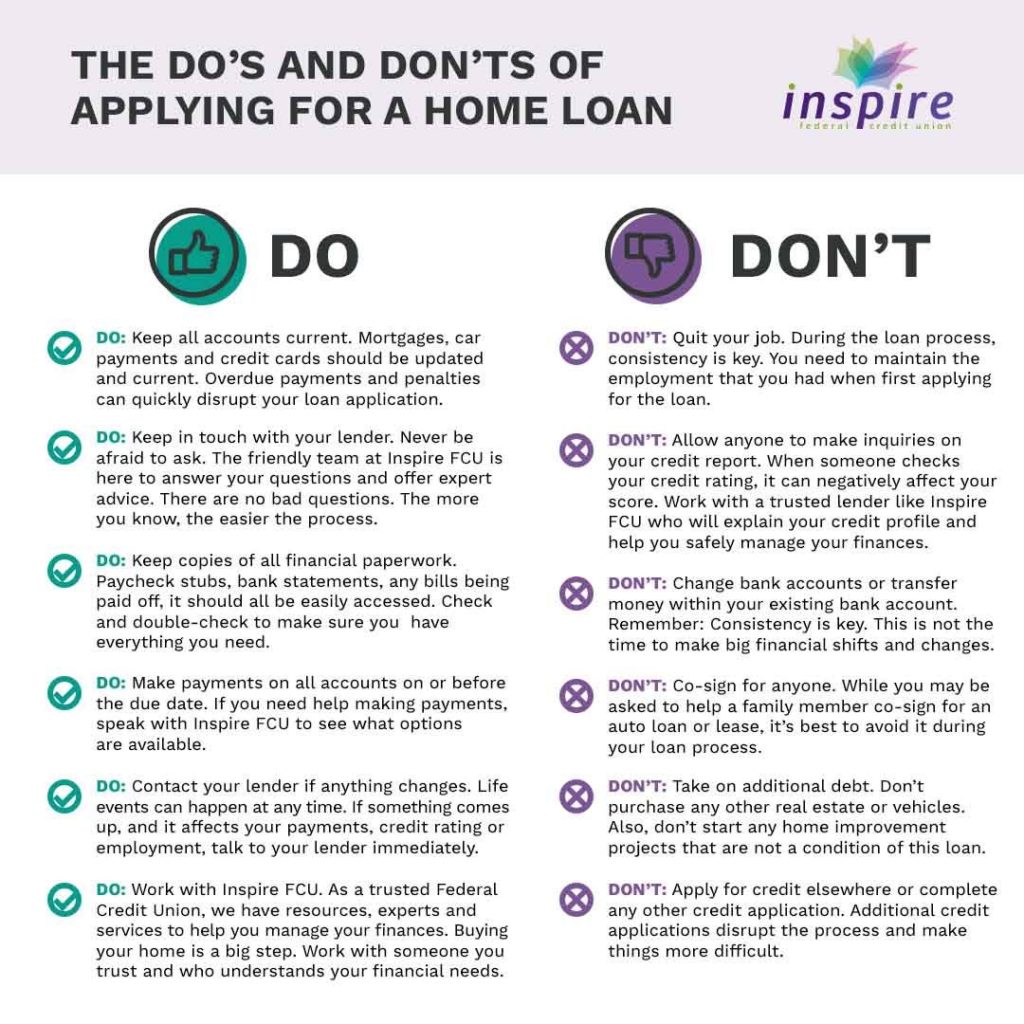

Inspire FCU offers competitive rates. Use this helpful guide to learn more about the differences and benefits of home loans and HELOCs.

Your Local Bucks County Credit Union

Get the most of your home by understanding how its equity works. It can seem confusing, but our team is always ready to answer questions.

Friendly expertise is one of the best reasons to work with Inspire FCU to take out a home loan. We help our members turn the equity of their homes into accessible cash by finding the right financial solution. If you want to tap into your home’s value, call or stop by your local branch.

Turn Home Equity Into Cash

*APR = Annual Percentage Rate. Subject to credit approval. Rates quoted assume excellent borrower credit history. Your actual APR will be based on creditworthiness and income. Qualifying applicants will receive an introductory rate of 0.00% APR that will expire after 6 months and a new rate will adjust to a variable APR between 2.99% – 7.25% APR, but not to exceed 15% APR, depending on creditworthiness and Loan to Value. Maximum loan amount eligibility for intro rate is $250,000. Loans greater than $250,000 will be subject to regular rate, which is based on prim rate as published in the Wall Street Journal plus/minus a margin. Existing Inspire FCU Home Equity Loans are not eligible for the introductory rate of 0.00%. Introductory rate is available to new home equity loan borrowers only. $5,000 initial draw required for Introductory rate. APR. Certain restrictions may apply to introductory rate and not all borrowers will qualify. Home Equity Line of Credit is a Variable Rate product which is based on the highest Prime Rate as published in the Money Rates Section of The Wall Street Journal in effect on the first business day of December, March, June and September of each year. (“Index”) plus or minus the margin – The Index plus or minus the margin equals the Interest Rate. Changes in the index will cause changes in the Interest Rate on the first day of January, April, July and October of each year. Interest you pay may be tax deductible. An early closure fee may apply – see Credit Union fee schedule for details. A credit union membership fee may apply – see Credit Union fee schedule for details. Property insurance is required for real estate secured loans. Consult a tax advisor regarding the deductibility of interest. The minimum monthly payment is $50.

*** Minimum loan amount is $50,000. If the loan is under $50,000 a $400 application fee will apply. Must be a first lien on property. Maximum loan-to-value 75%. Maximum Loan Amount $250,000. If a borrower receives an APR (annual percentage rate) of 3.09%, the borrower will pay 60 monthly payments of $18.01 per $1,000 borrowed. Example payment does not include amounts for taxes or insurance premiums, actual payment may vary. Rates and terms are subject to creditworthiness and other factors. Primary Residence only.