Staying On Top of Your Credit Has Never Been Easier!

Features & Benefits :

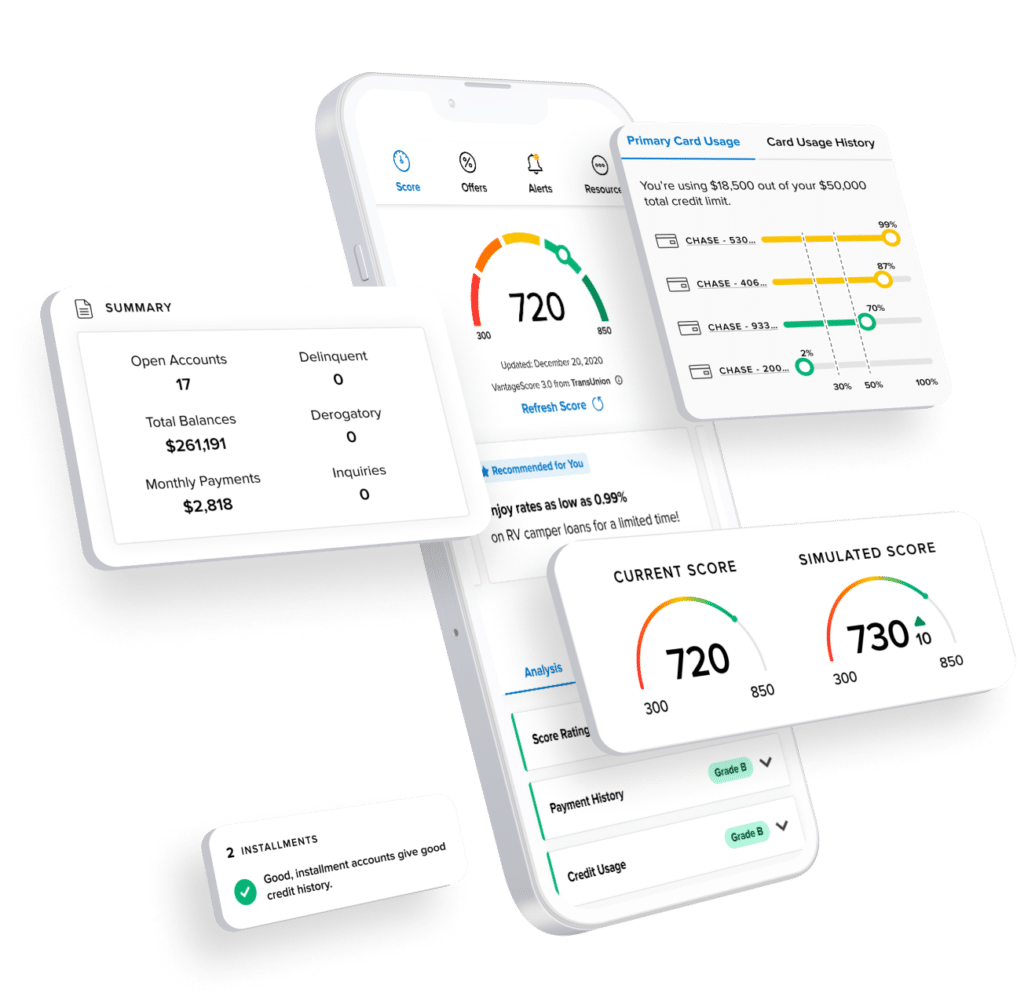

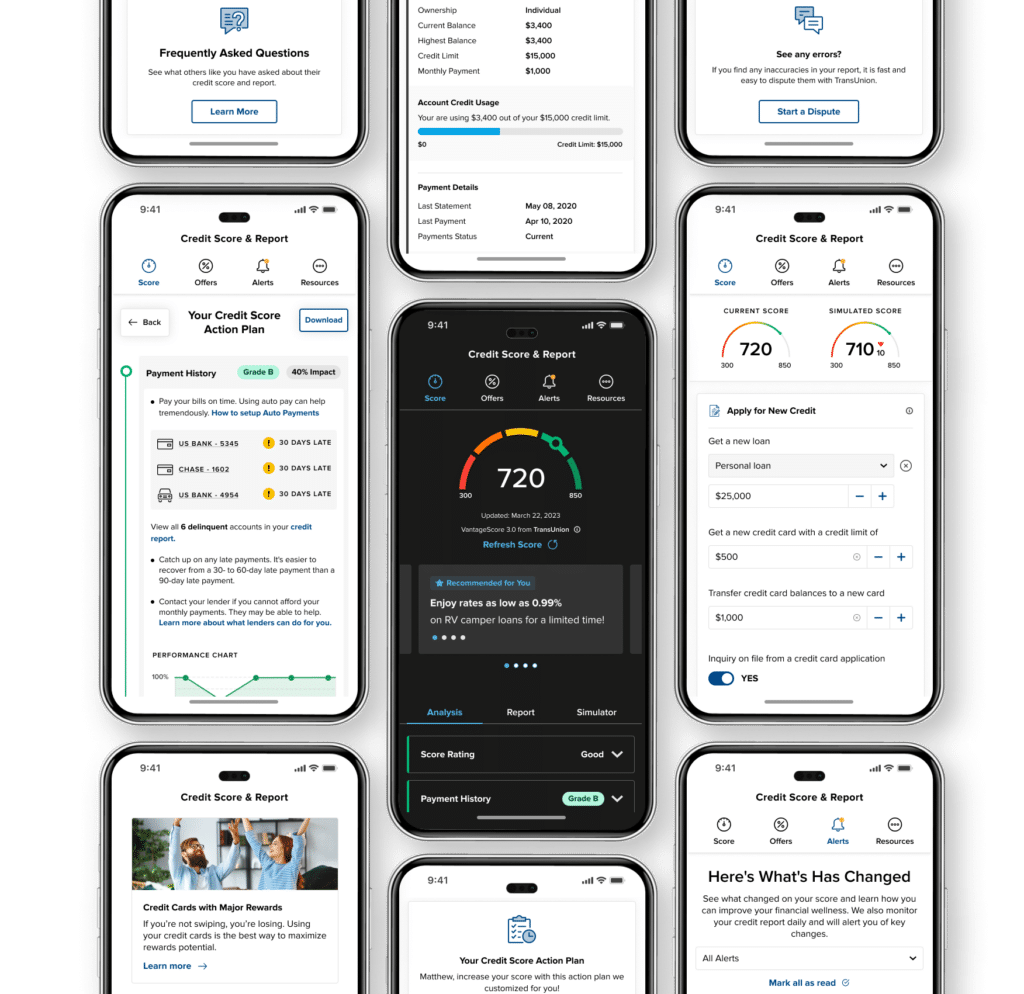

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

-

Daily Access to Your Credit Score

-

Real-Time Credit Monitoring Alerts

-

Credit Score Simulator

-

Personalized Credit Report

-

And More!

Access your credit score and report in our mobile app and online banking.

Frequently Asked Questions

SavvyMoney is a comprehensive platform that provides users with free and ongoing access to their latest credit scores and reports, real-time credit monitoring, and savings opportunities on existing and new loans and credit cards – all through their online and mobile banking

SavvyMoney Credit Report provides users with all the information they would find on a credit file

including a list of current or previous loans and accounts and credit inquiries. Users can see details on their payment history, credit utilization, and the public records that show up on their accounts. Like Credit Score, when a user checks their credit report, there’s no impact on their credit score.

Score Simulator is an interactive tool that allows users to see how hypothetical actions may affect their credit score, including things like paying off a credit card balance or applying for a loan. Just like checking their credit score through SavvyMoney, using the simulator does not affect the user’s credit

score.

No. SavvyMoney is entirely free to the user, and no credit card information is required to register

Every 7 days scores are updated and displayed in digital banking. Users can also refresh their score

and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score

Dashboard within digital banking.

SavvyMoney pulls users’ credit profiles from TransUnion, one of the three major credit reporting

bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three

major credit bureaus, to make score information more uniform between the different bureaus and

provide consumers with a better picture of their credit health. Key factors that drive the score are the

same.

There are three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring

models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus and scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical although there are similarities. SavvyMoney Credit Scores are represented in ranges, shown as follows:

• 780–850 – This scoring range is considered “Excellent.” Users in this range have very healthy

credit histories and are usually eligible for the lowest rates on loans and offers on credit cards.

• 660-779 – This score range is considered “Good.” These users have good credit but may have a

few minor issues. These users may still receive favorable rates on loans and cards.

• 600-659 – This scoring range is considered “Fair.” Users in this range may not get the lowest

rates on loans and opportunities to borrow start becoming limited.

• 500-599 – This scoring range is “Unfavorable.” Users in this range are new to credit or have

serious issues with their credit history. Users in this range may still get loans but at significantly

higher rates.

• Below 500 – This range is “Deficient.” Users in this range are new to credit or have had

significant defaults or other negative marks. Users in this range may find it hard to get loans.

No, Inspire uses their lending criteria when making final loan decisions and has no access to SavvyMoney Credit Score. However, through SavvyMoney Analytics we can see what offers users are viewing and engaging with.

SavvyMoney Credit Score is a free service to help users understand their credit health, make improvements in their scores, and see loan and credit card offers from Inspire FCU. Inspire FCU doesn’t have access to users’ credit files with SavvyMoney unless the users choose to share them. If they would like to share, they can easily do so by navigating to the Credit Report tab and clicking “Download Report” to share at their discretion.

SavvyMoney has implemented bank-level encryption and security policies to keep our user’s data safe and secure. SavvyMoney also has a sophisticated system that scans for, and thwarts online bots, intrusions, and attacks. SavvyMoney’s policies and processes are reviewed annually by a third-party auditor and have been verified by multiple digital banking platforms’ Security and Compliance teams to meet their stringent security guidelines to keep both users’ and financial partners’ data safe and secure.

No. Checking SavvyMoney Credit Score is always a “soft inquiry,” which does not affect credit scores.

Typically, ‘Hard inquiries’ are used by lenders to make decisions about their creditworthiness when

users apply for loans. Multiple hard inquiries can lower a credit score.

Yes. When a user successfully enrolls in the credit score solution, they are automatically enrolled in credit monitoring. Their file is scanned daily for key changes, and an alert is sent when a significant change is detected. These alerts are provided within digital banking and via email. The user can update

their email preferences for SavvyMoney emails by navigating to “Resources” and the “Profile Settings”

section.

SavvyMoney will provide the following monitoring alerts:

• An account has been included in bankruptcy.

• An account is reported as delinquent.

• A fraud alert has been placed on the credit file.

• A previously derogatory account is now current.

• A new account has been opened.

• An account in your name shows a different address.

• An account in your name listed a new employer.

• A new inquiry on the credit file.

• A new public record has been reported.

Yes, SavvyMoney Credit Score and all other features are available to use on mobile and tablet devices and are integrated within our mobile banking application.

Fill out the form below and we’ll be in touch shortly.